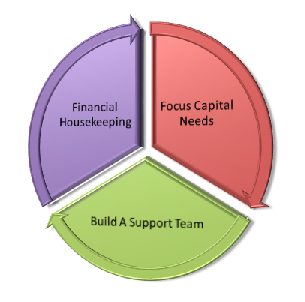

For entrepreneurs, capital, or the lack there of, is something that consistently keeps them awake at night. Unfortunately, just because an organization has built what they believe to be a better mouse trap, does not necessarily mean that the offers of new capital will come flooding in. How you approach raising capital is almost as important as looking for new capital. Over the years, I have found taking a simple 3-pronged approach to the capital process before heading into the funding arena can improve the outcome of the process.

Triangulation is one of my favorite concepts because it is as relevant in mathematics as it is in qualitative analysis. Interestingly enough, triangulation has business applications as well. For the surveyor, the objective of triangulation is to determine where you are standing in relation to two other points of reference. In business, triangulation can be viewed as a method to develop three foundational points that support a major objective. In the case of capital raising, triangulation can help an organization strengthen its footing before taking on the task of raising capital.

Focus. Every capital plan does not need to be a grand exercise in 5-year forecasting. Begin your plan by getting clarity on what you are trying to accomplish within the next year. Why do you need additional capital? What do you plan to do with the additional capital? Are you looking for a loan or equity investment? These are some questions that you should ask yourself before you begin to pitch your company. Don’t stop at asking these questions, spend som e time formulating answers that truly reflect the objectives of your organization.

e time formulating answers that truly reflect the objectives of your organization.

Housekeeping. This seems a bit basic, but make sure that your financial house is in order before you begin looking for loans or investors. Often you will need a good set of historical financial statements, tax returns, and forecasts. Are the assumptions in your budgets and forecasts reasonable? Are your balance sheet and income statements up to date? Realistically, can you service any new debt that you may take on? Are there things in your financial past, or the past of our organization that you honestly need to be able to address? Lenders and investors generally do not like surprises.

Support. Raising capital is a process. While there is always a chance that you will meet an angel investor that writes out a check to support your dream on the spot; the probability of that happening can be rather low. Finding a mentor or hiring an advisor with experience in capital raising, among other things, could be a good investment of your time and resources. Having a good sounding board or a second pair of eyes to review your financials and overall capital plan can save countless hours of pitching your project in the wrong places. An effective advisor can help to expand your reach by facilitating the relationship building with capital resources that you may need to support your venture through many stages of development. Ultimately, you will want to form a partnership with your lender or

investors. A seasoned advisor can help you to evaluate your options and chart a course that will be beneficial for your organizations as well as your capital partner.

I cannot stress enough that raising capital is a process that generally does not happen overnight. However, by investing some time and resources before actively looking for capital, you may increase the chance of a favorable outcome.

Shawn Powell Joseph is the president and CEO of Concentric Global Consultants, LLC (CGC), a boutique accounting and management consulting firm. She helps organizations thrive by focusing on both the financial and nonfinancial elements in business environments. Her philosophy for delivering value includes exploring new ways to apply innovation and fresh thinking to every stage of a company’s development.

Pingback: Cıvata